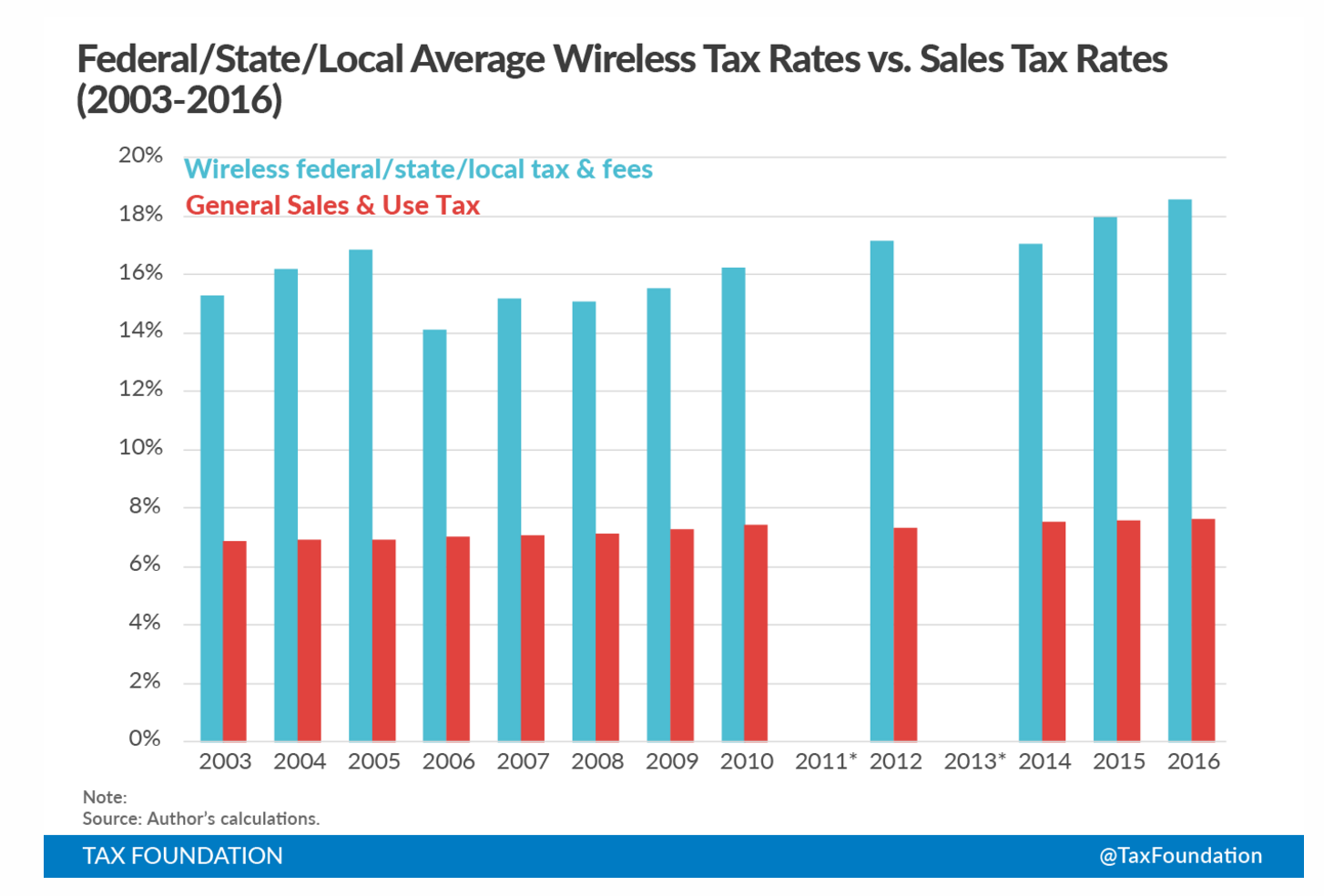

Taxes can add up as a portion of Wireless bills – almost 19% of a bill on average – so they are not something to be ignored. And tax rates are rising: 2014, 2015 and now calendar 2016 tax rates increased year over year and are at a record high.

According to the National Tax Foundation, “Taxes and fees on wireless consumers increased to a record high 18.6% of the average U.S. customer’s monthly bill. In just two years, the average wireless tax burden has increased by 1.5 percentage points, and wireless taxes are now 4.5 percentage points higher than they were ten years ago. A typical American household with four wireless phones paying $100 per month for wireless voice service is now paying nearly $225 per year in taxes, fees, and government surcharges” Wow — thats a new Smartphone, yo!

Here’s the thing we find most interesting:

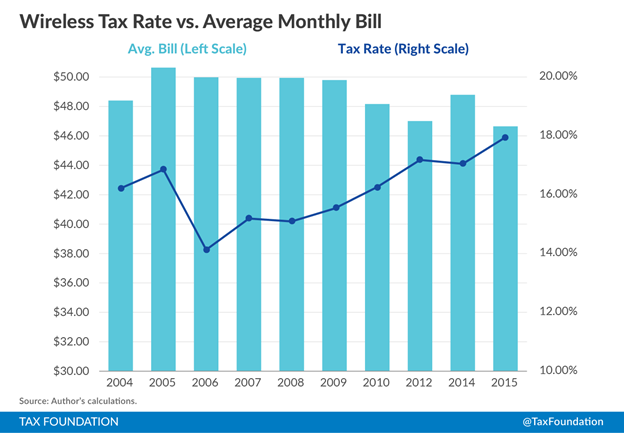

Since 2008, while Wireless Rates are continuing to decrease, (this is why you must watch your wireless bill!) from $46.44 per month in 2015 to $44.65 in 2016, (a 4% decrease), wireless taxes and fees have increased from 15.1% to the new record of 18.6% (a 23% increase!).

So, even if you are watching your bill and decreasing your monthly cost, you still got whacked with a higher burden tax rate than a typical consumer which can offset much of the net savings! Thanks Uncle Sam!!

You will see this in the Tax Foundation’s graphic below. The Foundation states, “national trends in state and local average tax rates on wireless service between 2003 and 2016. Between 2005 and 2006, wireless tax burdens dropped after a series of federal court decisions forced the IRS to end the imposition of the 3% federal excise tax on wireless service, reducing the average overall tax burden to 14.1%. Since then, rates climbed steadily until hitting the current record of 18.6%.”

How are Rates Charged?

Congress passed a Mobile Telecommunications Sourcing Act in 2002, which states that “a cell phone subscriber is liable for cell phone taxes only in his or her “place of primary use.”

Therefore, if you have an Ohio phone number, but live in Virginia and primarily use your mobile device in Virginia, you will liable for taxes only in Virginia.

What are the Tax Rates?

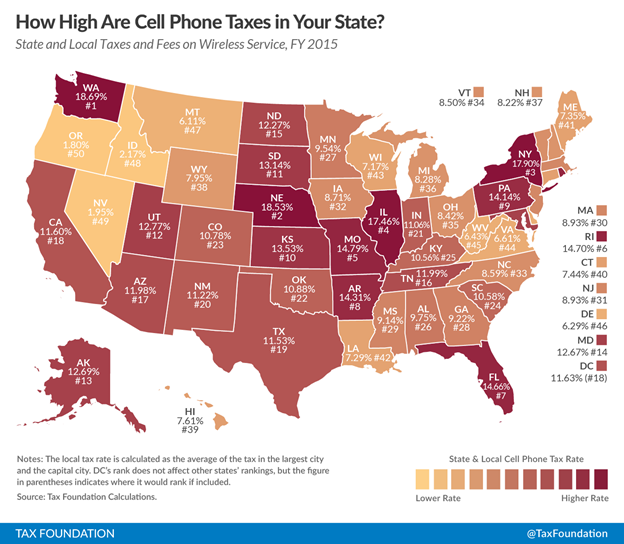

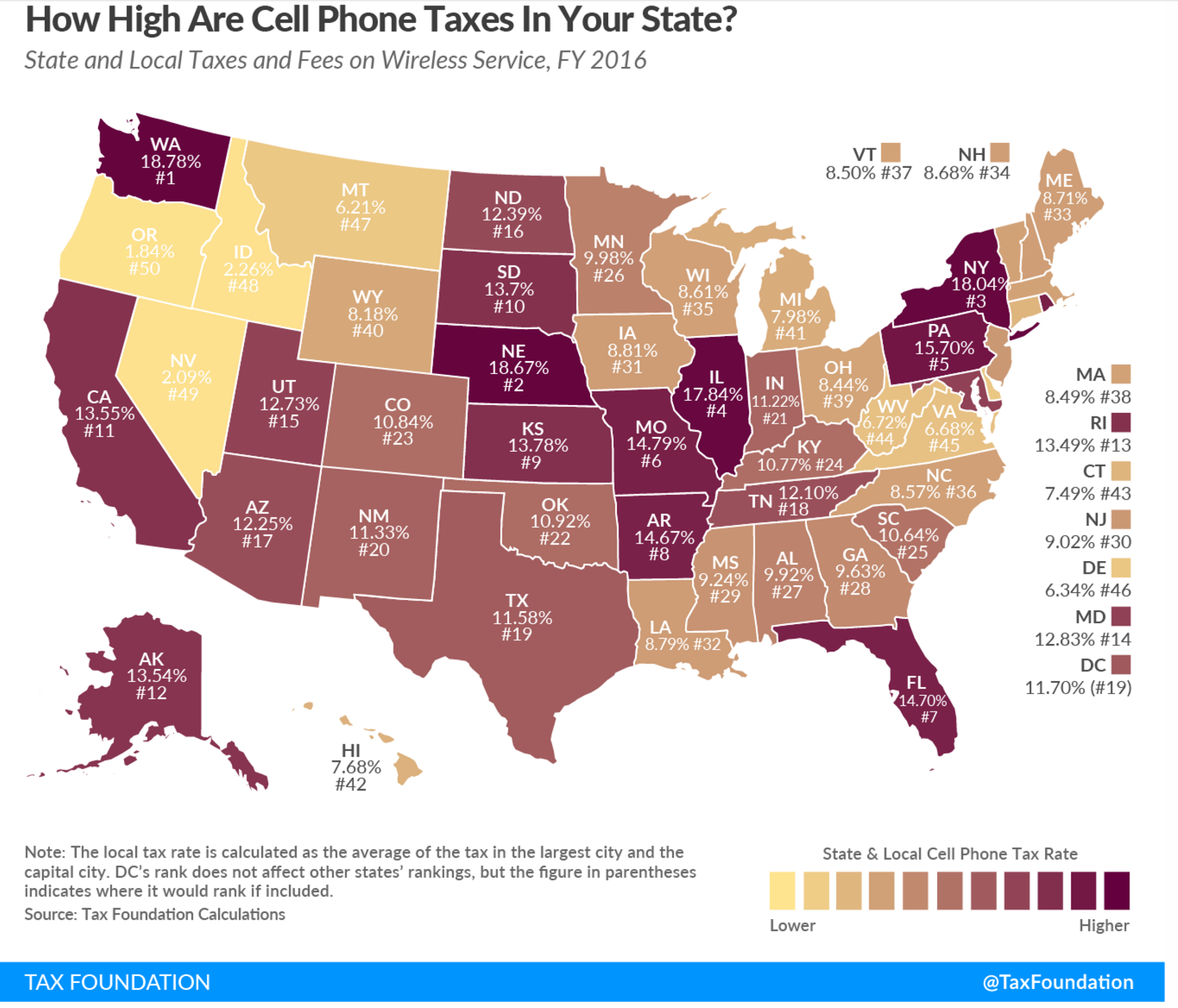

Tax rates average over 18% of a wireless bill but change based on location. This rate is almost 2.5 times higher than the average tax rates mandated on most other taxable goods and services, so get your money’s worth! Check out the below Map to see where you stand in relation to the rest of the country.

Source: Tax Foundation

Source: Tax Foundation

Hints on How to Manage Taxes

Keep your base rates low: BPI recently renegotiated rates and reduced a Client’s bill by over $50,000 per month (no, that’s not a typo, that’s a bunch of green). In doing so, taxes were decreased by over $15,000 per month because taxes are figured as a percent of the billed amount: lower rates, lower base to tax as a percent, lower tax.

So, the first BIG way to reduce taxes is to reduce your wireless spend. Keep monitoring those bills and continuing reductions: this will keep your taxes lower as a result.

Audit your Taxes and Fees:

The best way to make sure you are being taxed the correct amount is to actually compare your actual rates to what you should be charged. Yes, spend the weekend pretending you are a cool bill auditor and see how heroic you can become with your savings. Frequently, the state rates can be incorrect. Check out this link to find out what your Federal and State rates and look for Table 2.

Watch your Device Types with Surcharges and Rates: In a recent BPI audit it was determined that a significant portion of the incorrect billings were due to State Taxes and Surcharges by device type:

- Tax rates are different for different device types. In Virginia, for example, Smartphones should be charged a tax rate of 4% while Phone-only Devices should be charged a rate of 3.3%. BPI found examples of Phone-Only Devices being charged at the Smartphone Rate.

- State surcharges were charged for a smartphone but the billed device was phone-only. This was a 40% difference in rate and can add up over many devices.

So on this years Tax Weekend, make your taxes work for you: go ride on some publicly provided roads, enjoy your local library and if you go celebrate too hard, maybe you’ll have some cool interaction with some fellow brothers and sisters in blue.

If you have questions about saving your company money through the auditing, optimizing, or managing of your wireless services, please click here to contact The Bill Police.